Welcome To Street Investment

By Admin

Posted on December 14, 2023

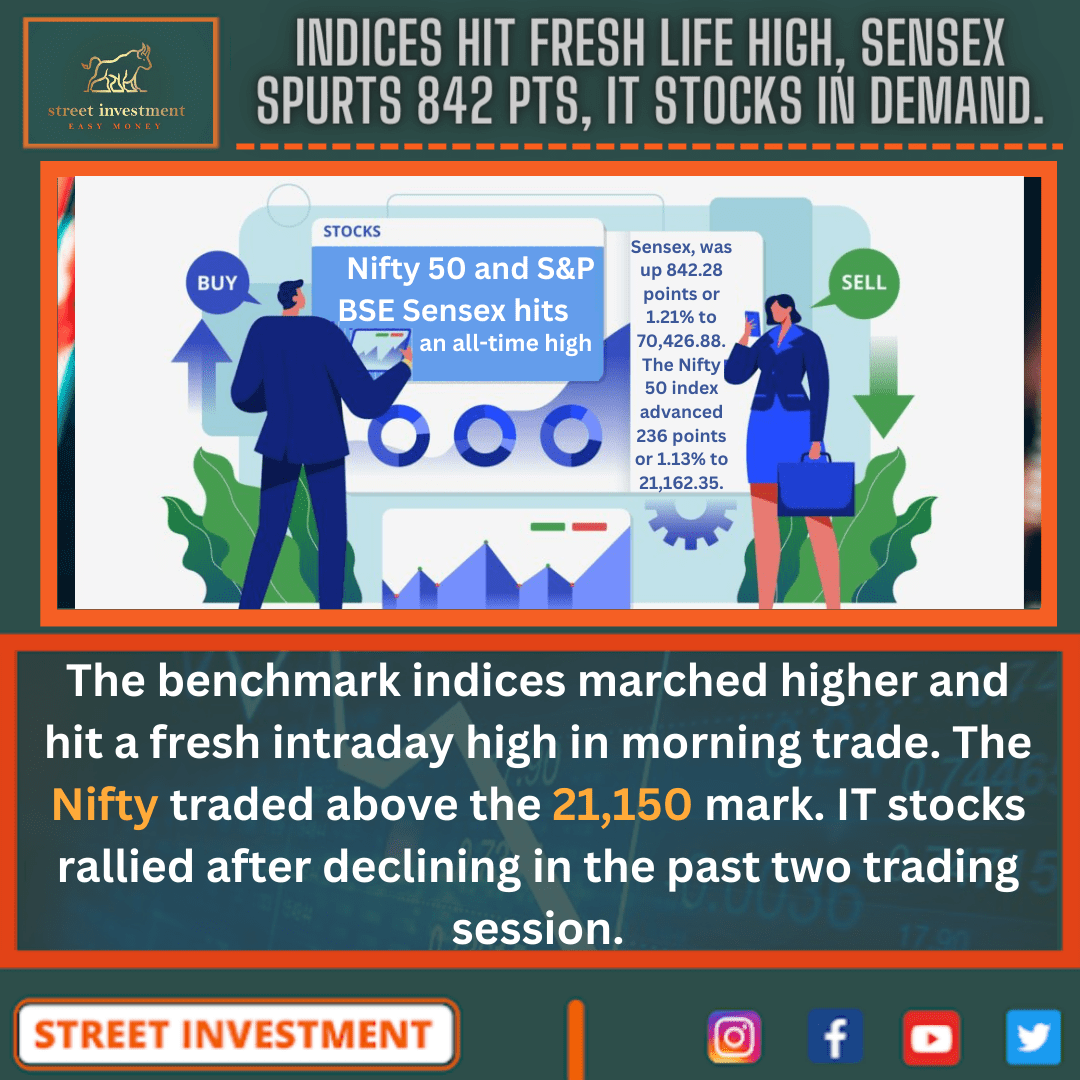

The benchmark indices marched higher and hit a fresh intraday high in morning trade. The Nifty traded above the 21,150 mark. IT stocks rallied after declining in the past two trading session sensex spurts 842 pts.

The barometer index, the S&P BSE Sensex, was up 842.28 points or 1.21% to 70,426.88. The Nifty 50 index advanced 236 points or 1.13% to 21,162.35.

The Nifty 50 and S&P BSE Sensex hits an all-time high at 21,189.55 and 70,540 respectively in morning trade.

In the broader market, the S&P BSE Mid-Cap index rose 0.71% and the S&P BSE Small-Cap index gained 0.81%.

The market breadth was strong. On the BSE, 2,252 shares rose and 1,195 shares fell. A total of 151 shares were unchanged.

The Nifty IT index advanced 2.63% to 32,910.30. The index fell 1.34% in the past two trading sessions.

Mphasis (up 5.6%), Coforge (up 4.92%), Persistent Systems (up 3.25%), LTIMindtree (up 2.95%), HCL Technologies (up 2.81%), L&T Technology Services (up 2.76%), Tech Mahindra (up 2.63%), Wipro (up 2.45%), Infosys (up 2.24%) and Tata Consultancy Services (up 1.71%) jumped.

Uno Minda rose 0.74%. The company has commissioned its new automotive seating systems plant under its subsidiary Uno Minda TACHI-S Seating Private Limited (UMTS) in Bhagapura, Ahmedabad, Gujarat. The plant will manufacture mechanical parts for automotive seats for passenger cars. UMTS has already received orders from OEM and is expected to start supplies by Q4FY24.

I G Petrochemicals added 0.34%. IGPL Energy is incorporated as a wholly owned subsidiary of the company on 30 November 2023 with Jebel Ali Free Zone, Dubai.

The yield on India’s 10-year benchmark federal paper fell 0.66% to 7.211 as compared with previous close 7.259.

In the foreign exchange market, the rupee edged higher against the dollar. The partially convertible rupee was hovering at 83.3000, compared with its close of 83.4025 during the previous trading session.

MCX Gold futures for 5 February 2024 settlement advanced 1.92% to Rs 62,374.

The US Dollar index (DXY), which tracks the greenback’s value against a basket of currencies, was down 0.38% to 102.48.

The United States 10-year bond yield declined 1.43% to 3.976.

In the commodities market, Brent crude for February 2024 settlement added 20 cents or 0.27% to $74.46 a barrel.

State Bank of India (SBI) rose 0.69%. The bank will be signing EURO 70 million Line of Credit with KfW (German Development Bank) for supporting Solar PV projects in India on 14 December 2023 at Bank?s IFSC Gift City Branch, Ahmedabad.

Biocon fell 0.18%. Bicara Therapeutics Inc. (Bicara), an associate company of Biocon, has completed its US$165 Million Series C funding. Consequent to this infusion of Series C funding and post allotment of shares by Bicara, the company”s shareholding in Bicara on fully diluted basis will fall below 20% and thereby, Bicara will cease to be an associate company of Biocon.

IRCTC advanced 1.62% after the company is eyeing expansion in the areas of business beyond Railways for promoting its brand and business across the nation. IRCTC has already signed MoUs with various government and autonomous bodies.

Asian stocks were trading higher on Thursday as investors embraced the U.S. Federal Reserve?s move to end its interest-rate-hiking cycle and signal cuts for the next year.

US stocks closed at yet another fresh highs of the year on Wednesday, with the dovish Federal Reserve signals pushing the S&P 500 closer to the all-time high. US Fed Chair Jerome Powell said inflation easing without an unemployment spike is good news, while reiterating that policy has moved well into restrictive territory.

The Fed held rates at 5.25%-5.5% for a third straight time and laid out the timeline for at least three quarter-percentage point cuts in 2024 and beyond. The Federal Reserve is willing to cut rates even if the U.S. economy doesn?t dip into a recession in 2024, Chair Jerome Powell said.

Later in the week, the European Central Bank (ECB) and the Bank of England (BOE), are also due to make policy announcements.