Welcome To Street Investment

By Admin

Posted on December 13, 2023

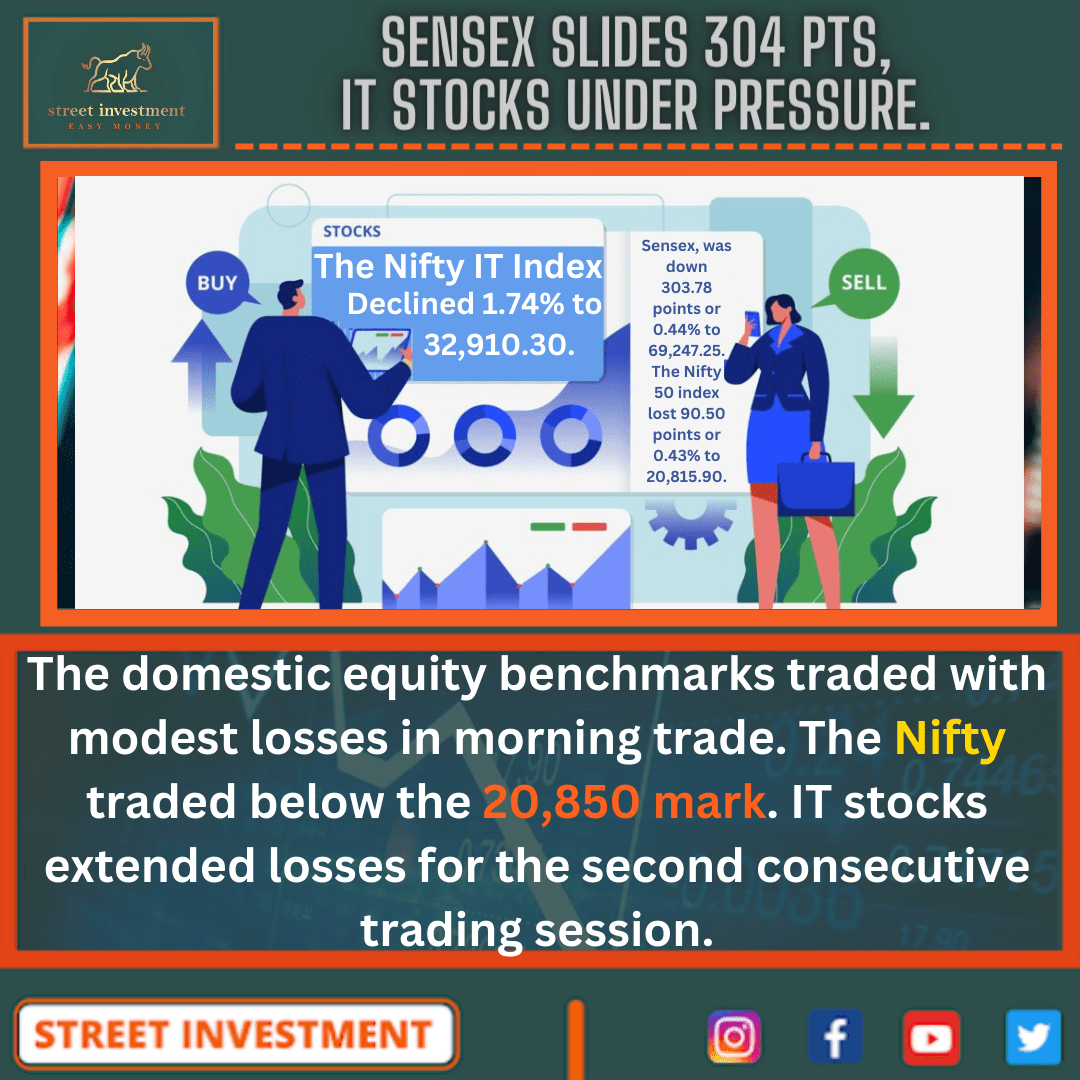

The domestic equity benchmarks traded with modest losses in morning trade. The Nifty & Sensex traded below the 20,850 mark. IT stocks extended losses for the second consecutive trading session.

The barometer index, the S&P BSE Sensex, was down 303.78 points or 0.44% to 69,247.25. The Nifty 50 index lost 90.50 points or 0.43% to 20,815.90.

In the broader market, the S&P BSE Mid-Cap index and the S&P BSE Small-Cap index added 0.09%.

The market breadth was positive. On the BSE, 1,955 shares rose and 1,482 shares fell. A total of 157 shares were unchanged.

The Nifty IT index declined 1.74% to 32,910.30. The index fell 1.8% in two trading sessions.

Tata Consultancy Services (down 2.23%), Coforge (down 1.52%), Mphasis (down 1.49%), Infosys (down 1.48%), Tech Mahindra (down 1.34%), L&T Technology Services (down 1.16%), LTIMindtree (down 1.01%), Wipro (down 0.82%), Persistent Systems (down 0.6%) and HCL Technologies (down 0.41%) edged lower.

Cummins India fell 0.35%. The company said that it has entered into collaboration with Repos Energy to launch DATUM (Data Automated Teller Ultimate Machine), an intelligent Fuel Management System.

Niraj Cement Structurals rallied 4.55% after the company announced that it has received work order from Jawaharlal Nehru Port Trust (JNPT) worth Rs worth Rs 210.98 crore. The value of the contract from JNPT is more than the present market capitalization of the company, which currently stands at Rs 188.09 crore.

KIOCL declined 1.43%. The operations of Pellet Plant Unit of the company at Mangalore have been temporarily suspended with effect from 12 December 2023 due to non-availability of iron ore fines.

Wipro fell 0.13%. The company announced that it has entered into a new agreement with RSA, one of the world?s leading general insurance companies. Wipro will help accelerate RSA?s migration to the cloud and build a compliant, secure, and scalable IT infrastructure.

Axis Bank declined 1.23%. Private equity major Bain Capital may sell a further stake in the private sector lender via a fresh block deal worth $444 million, as per reports. Entities associated with Bain Capital are looking to sell a 1.1% stake via a block deal in Axis Bank, and the offer floor price is Rs 1,109 per share, as per reports.

Laurus Labs slipped 2.40% after the company?s wholly owned subsidiary, Laurus Synthesis (LSPL) underwent US FDA inspection for the manufacturing facility in Parawada, Anakapalli, near Visakhapatnam, Andhra Pradesh. The inspection was conducted from 4th December 2023 to 12th December 2023. The company has been issued a Form 483 with five observations and it will address the observations within stipulated timelines.

The yield on India’s 10-year benchmark federal paper fell 0.15% to 7.264 as compared with previous close 7.275.

In the foreign exchange market, the rupee edged lower against the dollar. The partially convertible rupee was hovering at 83.3900, compared with its close of 83.3750 during the previous trading session.

MCX Gold futures for 5 February 2024 settlement declined 0.12% to Rs 61,105.

The US Dollar index (DXY), which tracks the greenback’s value against a basket of currencies, was up 0.03% to 103.89.

The United States 10-year bond yield declined 0.19% to 4.199.

In the commodities market, Brent crude for February 2024 settlement fell 20 cents or 0.27% to $73.04 a barrel.

Asian stocks were trading mixed on Wednesday, as investors assess the quarterly Tankan survey from Japan and ahead of the interest rate decision from the US Federal Reserve. The Tankan survey, compiled by the Bank of Japan quarterly, measures economic conditions in Japan.

US stocks closed at fresh highs of the year on Tuesday, after inflation data did little to alter views for the timing of a rate cut by the Federal Reserve, as investors awaited the central bank’s last policy decision of the year on Wednesday.

The United States Federal Reserve’s (US Fed) two-day monetary policy meeting is being held from December 12-13. And on Wednesday Fed Chair Jerome Powell will announce the central bank’s rate decision in a press conference. Besides the interest rate decision, Powell is also expected to release the central bank’s economic projections for the US. The Federal Reserve will opt to maintain interest rates at the current target of 5.25-5.50%, as per reports.

Later in the week, the European Central Bank (ECB) and the Bank of England (BOE), are also due to make policy announcements.