Welcome To Street Investment

By Admin

Posted on December 8, 2023

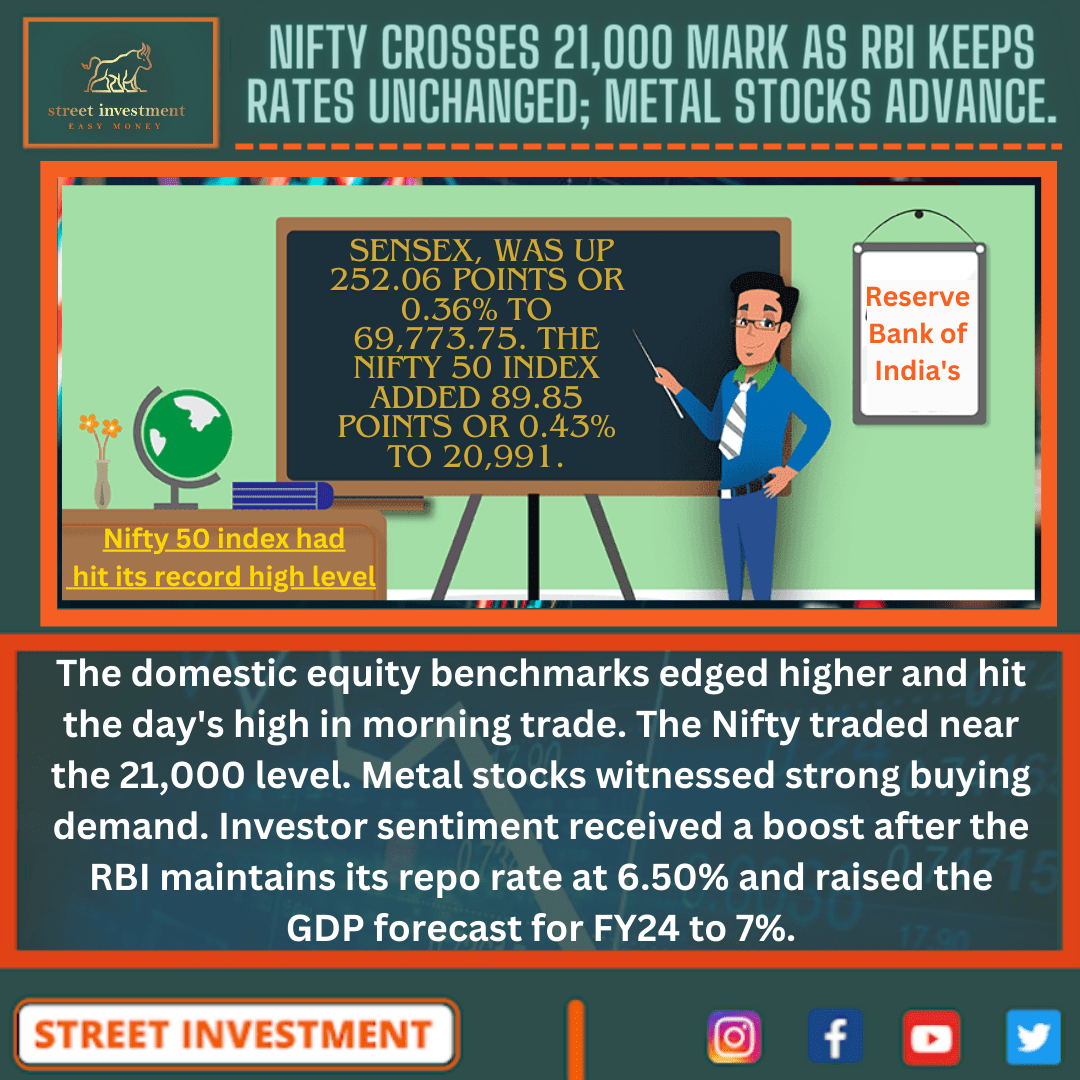

The domestic equity benchmarks edged higher and hit the day’s high in morning trade. The Nifty traded near the 21,000 level. Metal stocks witnessed strong buying demand. Investor sentiment received a boost after the RBI maintains its repo rate at 6.50% and raised the GDP forecast for FY24 to 7%.

The barometer index, the S&P BSE Sensex, was up 252.06 points or 0.36% to 69,773.75. The Nifty 50 index added 89.85 points or 0.43% to 20,991.

The Nifty 50 index had hit its record high level of 21,006.10 in trade today. The index took 61 sessions to gain 1,000 points & climb to 21,000 level from 20,000 level.

In the broader market, the S&P BSE Mid-Cap index added 0.30% while the S&P BSE Small-Cap index gained 0.45%.

The market breadth was strong. On the BSE, 2292 shares rose and 1148 shares fell. A total of 164 shares were unchanged.

The Reserve Bank of India’s (RBI?s) Monetary Policy Committee (MPC) kept its benchmark repo rate unchanged at 6.50% for fifth consecutive day at the end of its two-day policy meeting. The committee has maintained its stance of ?Withdrawal of Accommodation?.

The Central Bank has raised its FY24 GDP growth forecast to 7% from 6.5% earlier. The retail inflation (CPI) forecast for FY24 has been kept unchanged at 5.4%

The Nifty Metal index added 1.26% to 7,462.35. The index had declined 0.75% to end at 7,369.85 yesterday.

JSW Steel (up 3.22%), Hindustan Copper (up 3.09%), Welspun Corp (up 1.7%), Ratnamani Metals & Tubes (up 1.65%) and NMDC (up 1.55%) were the top gainers.

Among the other gainers were Vedanta (up 1.39%), Jindal Stainless (up 1.28%), Jindal Steel & Power (up 1.21%), Hindalco Industries (up 1.16%) and APL Apollo Tubes (up 0.89%).

On the other hand, National Aluminium Company (down 0.61%) and Hindustan Zinc (down 0.17%) turned lower.

IIFL Securities jumped 8.56%. The Securities Appellate Tribunal has set aside SEBI’s order prohibiting the company from onboarding new clients for two years and reduced the monetary penalty from Rs 1 crore to Rs 20 lakh.

Bharat Forge rose 0.73%. The company’s unit, Kalyani Strategic Systems, proposed to acquire a majority stake in Zorya Mashproekt India. ZMI is engaged in the development of indigenous capabilities for build-ups, repairs and overhauls of all types of gas-turbine engines.

IRB Infrastructure Developers advanced 3.56%. The company logged November toll collection at Rs 437 crore against Rs 366 crore in the same period last year.

TVS Electronics was up 0.20%. The company received an order from the office of the Commissioner of Customs on Dec. 6 to pay Rs 35.58 crore. It is the process of filing an appeal before the Customs Excise & Service Tax Appellate Tribunal, Chennai.

RBI’s MPC at its meeting today, 8 December 2023, decided to keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.50%. The standing deposit facility (SDF) rate remains unchanged at 6.25% and the marginal standing facility (MSF) rate and the Bank Rate at 6.75%.

All members of the MPC unanimously voted to keep the policy repo rate unchanged. The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4% within a band of +/- 2%, while supporting growth.

The real GDP growth for 2023-24 is projected at 7% with Q3 at 6.5%; and Q4 at 6%. Real GDP growth for Q1:2024-25 is projected at 6.7%; Q2 at 6.5%; and Q3 at 6.4%. The risks are evenly balanced.

CPI inflation is projected at 5.4% for 2023-24, with Q3 at 5.6%; and Q4 at 5.2%. Assuming a normal monsoon next year, CPI inflation for Q1:2024-25 is projected at 5.2%; Q2 at 4%; and Q3 at 4.7%. The risks are evenly balanced.

The minutes of the MPC?s meeting will be published on 22 December 2023. The next meeting of the MPC is scheduled during February 6-8, 2024.

Following the RBI announcement, the Nifty Bank index was up 0.54% to 47,096.00 while the benchmark Nifty 50 index was up 0.38% to 20,981.35.

HDFC Bank (up 1.21%), IDFC First Bank (up 1.14%), Bank Of Baroda (up 0.92%), Indusind Bank (up 0.74%), Kotak Mahindra Bank (up 0.23%), ICICI Bank (up 0.18%), Federal Bank (up 0.16%), SBI (up 0.12%) and PNB (up 0.12%) advanced.