By Admin

Posted on December 11, 2023

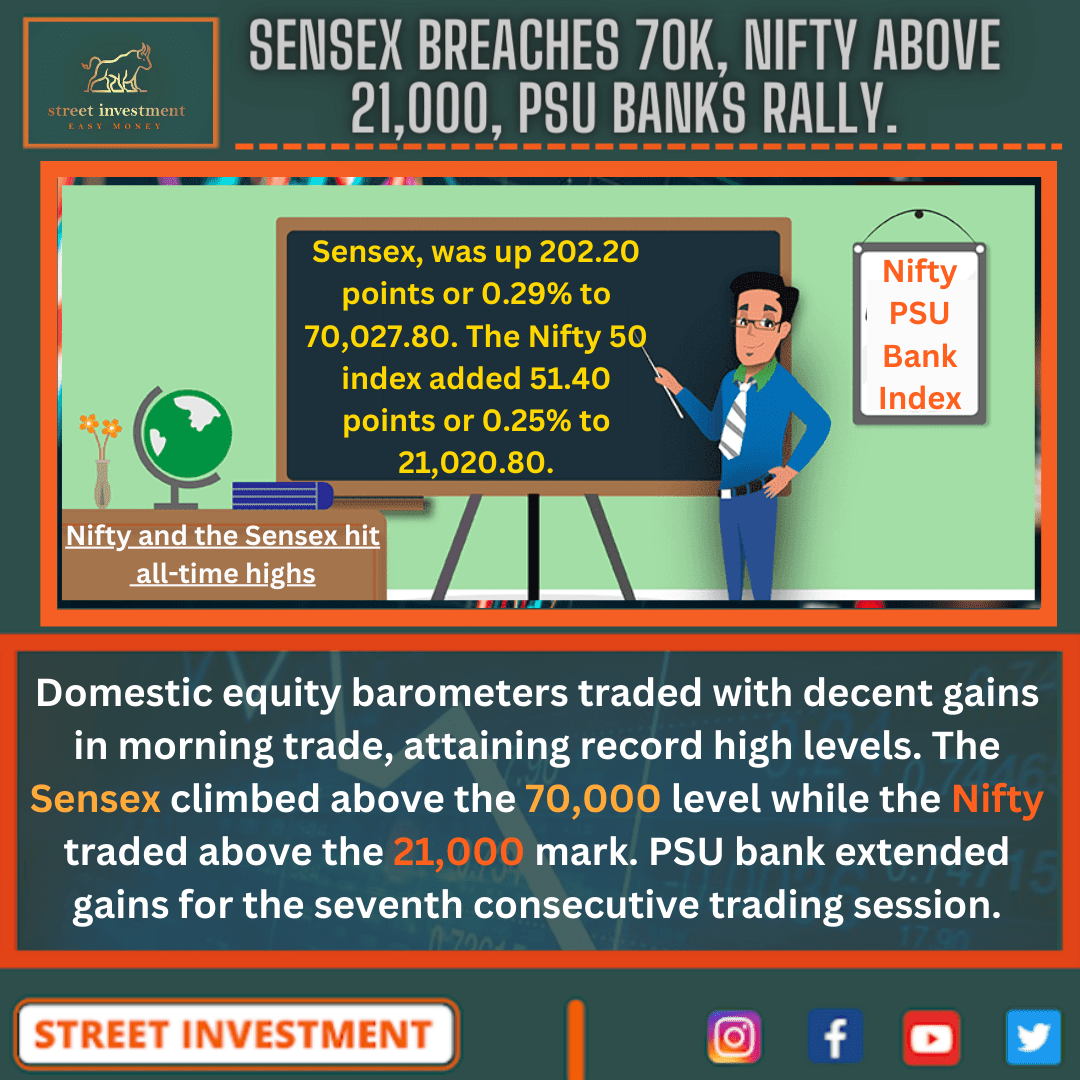

Domestic equity barometers traded with decent gains in morning trade, attaining record high levels. The Sensex climbed above the 70,000 level while the Nifty traded above the 21,000 mark. PSU bank extended gains for the seventh consecutive trading session.

The barometer index, the S&P BSE Sensex, was up 202.20 points or 0.29% to 70,027.80. The Nifty 50 index added 51.40 points or 0.25% to 21,020.80.

The Nifty and the Sensex hit all-time highs in mid-afternoon trade at 21,026.10 and 70,057.83, respectively.

In the broader market, the S&P BSE Mid-Cap index rose 0.63% while the S&P BSE Small-Cap index gained 0.66%.

The market breadth was strong. On the BSE, 2,373 shares rose and 1,172 shares fell. A total of 200 shares were unchanged.

The Nifty PSU Bank index rose 1.94% to 5,585.55. The index surged 10.8% in seven trading sessions.

Bank of Maharashtra (up 3.46%), Central Bank of India (up 3.19%), Punjab & Sind Bank (up 2.89%), Punjab National Bank (up 2.72%), Union Bank of India (up 2.3%), Bank of India (up 2.19%), Canara Bank (up 2.08%), Indian Overseas Bank (up 1.99%), Bank of Baroda (up 1.98%) and UCO Bank (up 1.88%) edged higher.

Tata Motors gained 1.24% after the car maker informed that it will increase the price of its commercial vehicles up to 3% effective from 1 January 2024.

PSP Projects added 0.99% after the company said that it has emerged as lowest (L1) bidder for a project in the state of Gujarat, worth Rs 296.85 crore.

REC shed 0.10%. The company announced that it has signed a loan agreement worth 200 million euro with the German bank KfW. This is REC?s sixth line of credit under Indo-German Development Cooperation, which the firm will utilize to re-finance investments in the distribution infrastructure of DISCOMs in alignment with the Revamped Distribution Sector Scheme (RDSS) of the Government of India.

Mazagon Dock Shipbuidlers rallied 4.09% afte the company announced that it has received an order worth Rs 1,145 crore from Oil and Natural Gas Corporation (ONGC) for the replacement of the pipeline.

Dr. Reddy’s Laboratories declined 5.87% after the company informed that the United States Food & Drug Administration (USFDA) issued a Form 483 with three observations after the inspection conducted at R&D centre in Hyderabad.

The yield on India’s 10-year benchmark federal paper rose 0.23% to 7.283 as compared with previous close 7.266.

In the foreign exchange market, the rupee edged higher against the dollar. The partially convertible rupee was hovering at 83.3725, compared with its close of 83.4000 during the previous trading session.

MCX Gold futures for 5 February 2024 settlement shed 0.17% to Rs 62,611.

The US Dollar index (DXY), which tracks the greenback’s value against a basket of currencies, was up 0.02% to 104.04.

The United States 10-year bond yield declined 0.14% to 4.241.

In the commodities market, Brent crude for February 2024 settlement rose 48 cents or 0.63% to $76.32 a barrel.

Asian stocks are mostly trading higher on Monday as investors assessed November inflation numbers from China, which declined at a faster-than-expected pace.

November inflation numbers from China showed a faster-than-expected decline in consumer prices. The consumer price index fell 0.5% year-on-year. The producer price index fell 3% year-on-year, compared with October?s 2.6% drop.

US stocks hit a new high for the year on Friday after the November jobs report and University of Michigan consumer survey data signaled a resilient economy and cooling inflation, fueling hopes for a so-called soft-landing scenario.

November?s nonfarm payrolls report showed an unexpected drop in unemployment. The jobless rate fell 3.7%. The US economy added 199,000 jobs during November, from 150,000 added in October.